ABOUT US

Barrow Hanley is a leader in global value investing, partnering with clients around the world to provide attentive service, insightful perspectives, and competitive returns.

Recognized as one of the few remaining firms dedicated exclusively to value investing, we enjoy a boutique culture with a singular focus to assist clients in meeting their investment objectives.

Read MoreWe have a four-decade history of organizational stability with a strong, investment-driven culture.

Our unwavering value philosophy and disciplined process utilized through multiple market cycles has led to a uniquely consistent client base.

Our HistoryOur experienced, stable investment team is our greatest asset.

We believe stability is a key component of any successful organization. Our established, solid base of investment professionals continue our longstanding commitment to the value investment style.

Our TeamBarrow Hanley integrates financially material ESG factors into our research and analysis process to mitigate risk and optimize shareholder value.

Our approach to responsible investing is underpinned by the Barrow Hanley Guiding Principles for Responsible Investing, and the key elements of PRI, ISG and IFRS.

Learn More

Barrow Hanley has been a proud supporter of the arts community in Dallas, Texas since our founding.

Clients and partners who visit our office experience first-hand our appreciation and respect for the arts as made evident by the various paintings and sculptures displayed. Not unlike the paintings hung throughout the office, employees of each successive generation leave their brushstrokes during their time at the firm, adding creativity and contributing to the legacy that is Barrow Hanley.

The Barrow Hanley Collection

Mayorga, Francisco Moreno

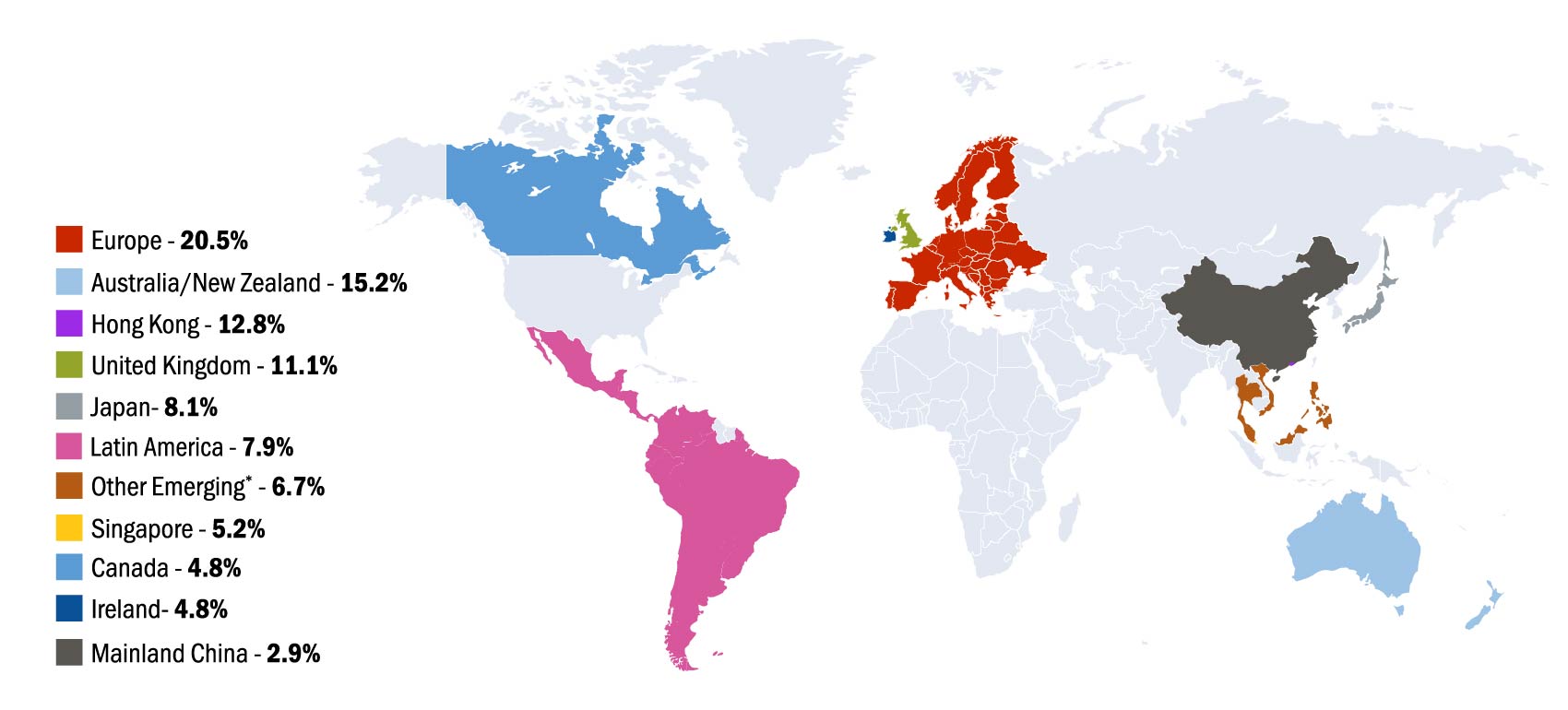

In November 2020, Barrow Hanley entered into a new strategic partnership with one of our existing clients, Perpetual Limited, an Australian financial services firm.

This partnership provides an opportunity for Barrow Hanley to offer its proven investment strategies to Australian, Asian and Pan-Pacific retail and institutional investors.

Read More (PDF)perpetual.com.au

%402x.svg)